|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

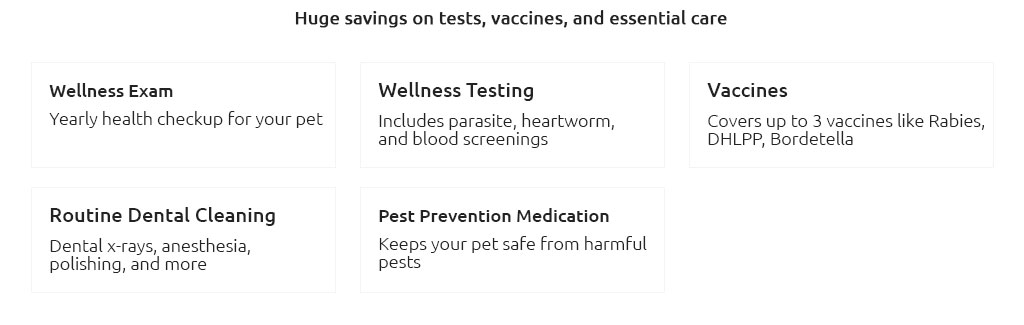

Go Compare Pet Insurance: A Comprehensive Guide to Finding the Best CoverageWhen it comes to protecting our furry friends, pet insurance can be a vital component of responsible pet ownership. This article will help you understand the various aspects of pet insurance and how to effectively compare different plans. Understanding Pet InsuranceWhat is Pet Insurance?Pet insurance is a policy purchased by pet owners to cover unforeseen veterinary costs. It can help manage expenses related to accidents, illnesses, and preventive care. Types of Coverage

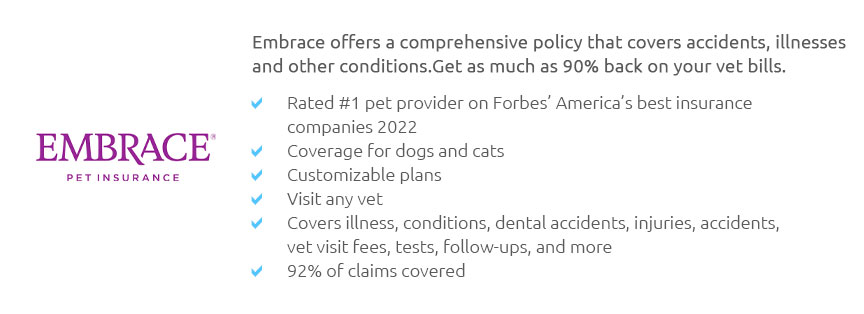

Key Factors to Consider When Comparing PoliciesCoverage Limits and ExclusionsDifferent policies have varying coverage limits and exclusions. It's essential to read the fine print to understand what is and isn’t covered. Consider what coverage is necessary for your pet's specific needs. Cost and ValueWhen comparing policies, consider both the premium and the deductible. It's important to balance cost with the benefits provided. You may want to explore how much is cat pet insurance to understand cost variations for different animals. Reputation of the ProviderChoose a reputable provider with positive reviews and a history of reliable customer service. This ensures you receive the support you need when making a claim. Benefits of Comparing Pet Insurance PlansComparing pet insurance plans can save money and ensure your pet receives the best possible care. By understanding the various options, you can select a plan that meets your needs and budget. Financial SecurityHaving the right pet insurance can provide financial security in case of unexpected veterinary bills. It can help avoid difficult decisions based on cost rather than care. Peace of MindKnowing that you have a comprehensive insurance plan in place offers peace of mind, allowing you to focus on enjoying time with your pet without worrying about future expenses. FAQs about Comparing Pet Insurance

For a more detailed understanding of cost considerations, you might want to explore how much is good pet insurance to ensure you choose the best plan. https://www.gocompare.com/pet-insurance/time-limited-pet-insurance/

... pet's health for the duration of their life. What do I need to get a quote? To obtain a time-limited pet insurance quote through Go.Compare, you must ... https://www.gocompare.com/pet-insurance/dog-insurance/

Dog insurance helps provide financial support for vet bills and other related expenses if your pet suddenly becomes ill or gets injured. https://www.gocompare.com/pet-insurance/cat-insurance/

Vet bills for cats can be pricey, so pet insurance is vital in case they have an illness or injury. Ceri McMillan - Pet insurance expert, Go.Compare. How much ...

|